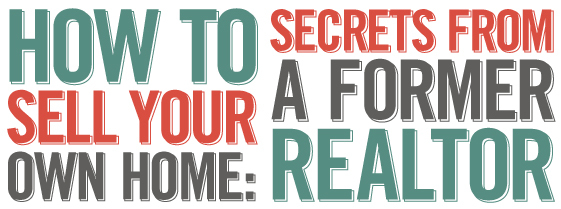

Thinking of selling your home? Now could be a great time—interest rates are still low, and mortgages are more accessible to buyers than they’ve been for a long time. Even better—the housing inventory for homes that are not short-sales or foreclosures is very low. Selling your own home, instead of using a Realtor for the transaction, can save you some money. It’s not for everyone, but if you’re up for the task, we’re here to guide you through it.

I worked as a Realtor for four years and had the pleasure of working with both buying and selling clients. During that time, the housing market was booming and so was business. I learned a lot about the psychology of home buyers, the most effective  marketing techniques for selling a home and the legal pitfalls that can happen during the course of a real estate transaction. I learned a few secrets here and there… and I’m willing to share these tips and secrets with you.

marketing techniques for selling a home and the legal pitfalls that can happen during the course of a real estate transaction. I learned a few secrets here and there… and I’m willing to share these tips and secrets with you.

I’ll also give you a heads-up on some of the real estate lingo you’ll run into during the process of selling your home, and you’ll get some advice from Realtors who are working in the business today, as well as from a real estate attorney.

Should You Sell Your Home Yourself?

Selling your home on your own might not sound so difficult. After all, Americans are unafraid to take on new challenges. We learn basic plumbing skills to fix the leak in the sink. We learn how to trim our kids’ hair. We change our own oil, fertilize our own laws, tile our own bathrooms. Sometimes this works out well—we save a buck or two. Other times, we end up taking our kids to the hairdresser to fix the crooked hack job we committed in the name of frugality.

Should you sell your own home? The answer is… maybe. If the market is right, you’re not in a huge rush to sell, you’re practical, do your homework and stay focused, organized and diligent throughout the process, you might do well. On the other hand, if you’re not up for the task, selling your home without a realtor might not be the best idea.

Will You Really Save Money?

Listing your home with a Realtor will typically cost you around 6% of the sales price. For a home worth $250,000, that’s $15,000—a fair chunk of change. Selling on your own will save you at least half of that commission (if your buyer comes in with a Realtor, you will probably have to pay 3% or so to that person). So, you may save some money.

Then again, you may not. Savvy buyers know about the 6% Realtor commission. Unless you’ve already priced your home below market value, they may automatically offer 6% less, based on the fact that there aren’t any Realtors involved. Frankly, they have a valid argument. If the exact same home down the street is priced at $250,00 also, but is listed with a Realtor, that seller will receive $235,000. Why should you receive more for your home?

Then again, you may not. Savvy buyers know about the 6% Realtor commission. Unless you’ve already priced your home below market value, they may automatically offer 6% less, based on the fact that there aren’t any Realtors involved. Frankly, they have a valid argument. If the exact same home down the street is priced at $250,00 also, but is listed with a Realtor, that seller will receive $235,000. Why should you receive more for your home?

What typically ends up happening is that you discount the price of your home by 6%. Which means that you’re making the same amount of money as you would when listing with a Realtor, but you’re doing all the work of selling your home yourself.

How Are Your Negotiation Skills?

The National Association of Realtors reports that people who sell their own homes typically receive 10-20 percent less than those who list with Realtors, mainly because many sellers don’t have the skills to negotiate the best contract. While the NAR certainly has a stake in that kind of survey, you might want to take an honest look at your skill set before you assume that you’ll save money by selling yourself.

Can You Be Brutally Honest With Yourself?

When you list with a Realtor, she’ll come into your home, look around, and make recommendations about what you need to do in order to get the highest offer possible. While you might not agree with everything she has to say, she really has no reason to lie to you—the higher your sales price, the higher her commission. Realtors have a lot of experience with buyers and their preferences. They aren’t emotionally connected to your home, so they can see it with unbiased eyes.

Last summer, I wrote a fun post called, “The Top 10 Signs The House Ain’t Selling.” It’s meant to be tongue-in-cheek and humorous, but several of the “signs” come from real-life scenarios. Check it out… and make sure none of them sound like you.

Can You Leave Emotion Out of the Negotiation Process?

Speaking of being emotionally connected, this can be a real drawback when selling your home yourself. You have a lot of memories tied up in your home—bringing home your first child, making snowmen in the yard, marking your child’s height in the doorway every year when school starts. It’s difficult to look at your home from a strictly financial perspective. This can bite you during negotiation.

I remember one situation where emotion cost a client money. Mrs. G had a beautiful home. She’d raised four children there and had lots of great memories. One afternoon, a young couple drove by, saw the For Sale sign in the front yard and knocked on her door to ask if they could walk through. Despite my recommendation against that kind of showing, Mrs. G let them in and proceeded to talk to them for four hours. The couple was expecting their first baby and they fell in love with the house. Mrs. G fell in love with them. She had visions of a new family growing up in her home, and she really liked the couple.

I remember one situation where emotion cost a client money. Mrs. G had a beautiful home. She’d raised four children there and had lots of great memories. One afternoon, a young couple drove by, saw the For Sale sign in the front yard and knocked on her door to ask if they could walk through. Despite my recommendation against that kind of showing, Mrs. G let them in and proceeded to talk to them for four hours. The couple was expecting their first baby and they fell in love with the house. Mrs. G fell in love with them. She had visions of a new family growing up in her home, and she really liked the couple.

Unfortunately, Mrs. G’s home was worth $30,000 more than the prospective buyers could afford. Once I had spoken to them (and their loan officer), I told Mrs. G that they wouldn’t work out—they simply couldn’t afford it. She had other ideas. She called the couple and offered to sell the house to them for $30,000 less than the asking price. They, of course, accepted.

This seems like a nice, philanthropic gesture, doesn’t it? Mrs. G was in the process of completing her own purchase on a condo, but after the sale of her house closed, she found out that she couldn’t obtain financing without the money she had basically given away. Emotions cost her $30,000… and the home she would live in for the rest of her own life.

This kind of scenario is rare when homeowners hire a listing agent. Most of the time, clients take heed of their Realtor’s advice and aren’t present when buyers walk through. But when you sell your own home, you’ll be the one walking every buyer through.

Real estate is a financial asset, much like your 401k and stocks. But you’re not really emotionally connected to your 401k, are you? When selling your home, you absolutely must maintain an emotion-free attitude… or you’ll lose money.

Can You Be Firm With People?

Smart Realtors only show homes to buyers who have been pre-qualified with a lender. Otherwise, they’d spend a lot of valuable time walking through homes with people who  are just lookie-lous… playing “let’s look at nice houses we might be able to afford someday.” When you sell your home yourself, you should also insist that prospective buyers bring a pre-qualification letter with them. Otherwise, you’re wasting your time and potentially bringing people into your home who might have nefarious plans.

are just lookie-lous… playing “let’s look at nice houses we might be able to afford someday.” When you sell your home yourself, you should also insist that prospective buyers bring a pre-qualification letter with them. Otherwise, you’re wasting your time and potentially bringing people into your home who might have nefarious plans.

One well-known scheme is for people to walk through a home, taking notes of all the expensive items they can then come back and steal later (or, if left unattended, they may take small valuables during the walk-through). Other people may want to enter your home with the intention of doing you harm. Realtors are aware of these criminals (and others) and are both wary and prepared.

If saying, “no” to people makes you uncomfortable, you probably shouldn’t sell your home yourself.

Are You Willing to Do the Work?

It’s tempting to feel as though Realtors make way more money than they’re worth. For some rare transactions, that might be the case. But most of the time, your Realtor is spending many hours working on marketing your home and getting a contract to completion. When I worked as a Realtor, I regularly worked a 65-70 hour week. I had years of accumulated knowledge. I answered the phone when it rang (even at midnight) and went out in snowstorms to show homes or attend closings with clients. Was I worth my commission? Absolutely.

Many people think that selling a house is easy—you just throw a sign in the yard and wait for someone to come along and offer you money. You need to be prepared to put in the work required to sell your home.

Rhonda Taylor, a Realtor with seven years of experience, told me, “I understand that

people are trying to save money. However, it’s not just about getting an offer on your home. That’s the easy part. My value comes in when all the unimaginable things that you can’t even fathom come up. I’m a master at keeping things together and making sure it the deal closes. I have the resources and experience. I know how to market, sell and handle the paperwork required for real estate transactions. That’s what I do for a living, and I’m good at my job.”

Realtors deal with some pretty crazy issues. If you’re selling your own home without a Realtor, it might be advantageous to get inside their heads a bit and see what their daily work looks like. One of our recent posts, “What Your Realtor Wants You to Know About Buying and Selling,” talks about the crazy things that buying and selling clients do that drive Realtors crazy. Make sure that, as a seller, you’re not doing any of them! And read up… because you’ll soon be dealing with buyers.

Sell Your Home Yourself.

Despite my cautions above, selling your home yourself might be a really good idea, if you can do the following:

-

Be reasonable about the listing price.

-

Think of the transaction as strictly financial—leave emotions out of it.

-

Be a strong negotiator.

-

Be firm with strangers.

-

Be prepared to work hard to sell your home.

If you honestly think that you’re unable to do those five things, then call a Realtor to sell your home for you. If you can, great! Read on for plenty of great tips to help you be successful.

How Much is My Home Worth?

Well, there are three answers to that question: the tax assessed value, the current appraised value and the actual market value. It seems counterintuitive, but they can be quite different numbers. Here’s a breakdown on each.

Tax Assessed Value

This is the number on your property tax statement. It could be several years old, and it might not represent the full value of your home. The assessed value is the amount used when calculating annual property taxes. Your tax assessed value is determined by local government: your state, county or city. Some localities assess properties at less than full value; as little as 70%, for instance. Some assess annually; others much less often. If your home was last assessed during the real estate bubble, the number might be very high (most assessors have adjusted for the crash at this point. If yours hasn’t, you need to ask for a reassessment). Whatever you do, don’t think that your home is worth what the local government says.

This is the number on your property tax statement. It could be several years old, and it might not represent the full value of your home. The assessed value is the amount used when calculating annual property taxes. Your tax assessed value is determined by local government: your state, county or city. Some localities assess properties at less than full value; as little as 70%, for instance. Some assess annually; others much less often. If your home was last assessed during the real estate bubble, the number might be very high (most assessors have adjusted for the crash at this point. If yours hasn’t, you need to ask for a reassessment). Whatever you do, don’t think that your home is worth what the local government says.

Current Appraised Value

This can be a tricky number, too. If you hire an appraiser to give you a current value, make sure that you tell him that you’ll be using the value to price your home for sale.  He’ll come to your home and walk through, then measure everything. Then, he’ll look at similar homes recently sold in your immediate area—the “comps.”

He’ll come to your home and walk through, then measure everything. Then, he’ll look at similar homes recently sold in your immediate area—the “comps.”

Your appraiser will gather the comps, then make adjustments based on the differences between your home and those. For instance, he might add another $5,000 if you have 4 bedrooms and the others only have 3. Or he might deduct $10,000 if the other homes all have tennis courts and yours doesn’t (I’m just throwing random numbers in here, by the way… those values will vary wildly). At the end of all the adjusting and figuring, the appraiser will come up with a number that he feels accurately represents the value of your home.

It can be difficult to get an accurate appraisal in a recovering market. There may not be any recently sold homes in your neighborhood that are similar enough to yours to use as comps. Or, there may have been many sold, but they were foreclosures, and as a result, sold for much less than market value. This puts the appraiser in a tricky position; he doesn’t want to over-appraise your home, but he doesn’t really have any good numbers to base his appraisal on.

Most of the time, appraisers are looking at homes that have a current offer on them. In that case, he knows that someone is willing to pay that amount for the home, and that carries a lot of weight. Good appraisers also keep in close contact with local Realtors, so they are aware of increasing (or decreasing) home values based on the offers that are coming in on listed properties. A real estate purchase contract, at the very least, gives an appraiser somewhere to start.

True Market Value

The true market value of your home is, in the simplest sense, whatever someone is willing to pay for it. If you list your home for $350,000 and a buyer shows up with cash and buys it, it’s worth $350,000. However, if that buyer needs a mortgage, and the appraiser says the home is worth $250,000, the buyer must decide whether he’s willing to pay the extra $100,000 (out of his pocket). If he’s not, then your home is worth more like $250,000.

A comparative market analysis (CMA) from a Realtor is one of the best ways to get an  accurate representation of the current value of your home. Realtors know what’s going on in your neighborhood, what homes are appraising for, and what’s selling. They use a similar formula as appraisers to determine your home’s worth-a combination of data from sold homes, your home’s square footage and features. They’ll also factor in currently listed homes, and any special features your home has that might be worth more money.

accurate representation of the current value of your home. Realtors know what’s going on in your neighborhood, what homes are appraising for, and what’s selling. They use a similar formula as appraisers to determine your home’s worth-a combination of data from sold homes, your home’s square footage and features. They’ll also factor in currently listed homes, and any special features your home has that might be worth more money.

If you’re listing with a Realtor, it’s the first thing she’ll do, and she won’t charge you any money for it. You might consider contacting a Realtor to see if she will provide you with a market analysis. Both Realtors I spoke to told me that they are willing to help people with a CMA, even if those people are selling without a Realtor. Rhonda Taylor said, “I always offer this as a free service. I have specialized access to that information, and I’m happy to help when I can. I look at it as an opportunity to make another connection— that person may not need my help, but he may have friends that do.”

Laura Hyde, a Realtor with Thornton Walker Real Estate, had another good point, “I have no problem helping homeowners who are attempting to sell on their own. I know that the odds are good that they’ll decide they need a Realtor down the road. If so, I’ve already established that relationship. I love meeting new people, learning about them and seeing their beautiful homes.”

Whatever you do, don’t pretend that you’re going to list with a Realtor in order to get all the goodies, and then flake out. Not only are you taking up someone’s valuable time and resources, you’re earning yourself a bad reputation. Realtors talk to each other, and those who may have qualified buyers for your home might avoid you based on your bad behavior. Who wants to work through a real estate contract and home selling process with someone who has already proven to be deceptive?

Listing High

You might be inclined to inflate the value of your home when listing, figuring that it gives you room to negotiate. Good Realtors don’t do this, and you shouldn’t either. Savvy buyers quickly become aware of the market value of the homes they’re looking at. They spend lots of time walking through comparable homes, and they’re very good at comparing one to the other.

When an interested buyer calls about your home, the first question out of his mouth will be, “How much are you asking?” If that number is higher than he expects, he likely won’t even bother to deal with you. Listing at the actual market value isn’t detrimental to the negotiation process; if you have plenty of interest in your home, you shouldn’t need to accept less than the asking price.

What Needs to Be Done to Sell This House?

Your home is your castle, and you probably think it’s perfect. Who wouldn’t want to buy it? Well, to be honest… most homes need a little prep before listing.

Curb Appeal Matters.

I’ve had many a buyer refuse to enter a home based on the way it looked from the curb. Sometimes it’s something that isn’t the fault of the owner—the buyers don’t like fruit trees, for instance. But most of the time, it’s one of several common factors:

- Unkempt lawn and landscaping

- Dirty windows

- Cluttered porch and driveway

- Peeling paint

- Obvious roof damage

- Tacky or dated colors

- Damaged or missing siding, trim or rain gutter

- Broken concrete in the driveway, walk or porch

You’ve heard about the first impression rule, right? If you make a poor first impression, you probably won’t get the chance to make a better second one. Take care of all the items on the list above.

Help Potential Buyers Imagine Themselves Living in Your Home.

Ideally, your home will be as neutral as possible. Not everyone shares your taste for  porcelain doll collections or taxidermy deer heads. Potential buyers aren’t there to admire your taste in decor or personal collections—they want to envision themselves living in the home. To help them do so, stage your home. First, tackle the items on this list:

porcelain doll collections or taxidermy deer heads. Potential buyers aren’t there to admire your taste in decor or personal collections—they want to envision themselves living in the home. To help them do so, stage your home. First, tackle the items on this list:

-

Remove personal photos

-

Remove extra clutter, including your collectibles

-

Replace brightly colored carpet with neutral colors

-

Remove wallpaper and wallpaper borders and repaint in a neutral color

Meet or Beat the Competition

Buyers want to be able to move right in without having to spend a bunch of money. The extent to which your home should be updated and current depends on your competition. Do all the other homes in your price range have new kitchens? A deck? A finished basement? If so, you have two choices:

1) Update your home to match.

2) Lower your sales price so that the buyer can do it himself.

Be careful completing renovations before listing your home— you might not always be able to recoup the costs. Do the bare minimum to bring your home up to neighborhood standards; no more, no less.

Clean, Fix and Organize – How To Stage a Home

The biggest complaint from buyers who are looking at homes is that so many of them are dirty, smelly and cluttered. You absolutely must make your home an attractive, pleasant place to be, or you’ll have a very difficult time finding a willing buyer. Here’s a list of home staging tips and things to do, room-by-room.

Every Room:

First, clean out every closet and storage space throughout the house. Get rid of stuff you don’t use—host a yard sale, donate items to Goodwill or throw things away. Buyers love to open closets and cabinets, and they love the idea of having lots of storage. Your closets will look much larger if they’re almost empty. Do a thorough cleaning and reorganization of:

-

Garage

-

Storage shed

-

Basement

-

Crawl space/attic

-

Bedroom closets

-

Coat closet

-

Pantry

-

Kitchen cabinets

-

Bathroom vanity cabinets

-

Linen closet

-

Under-the-stairs closet

-

Laundry cabinets

Consider renting a storage unit for awhile. Holiday decorations, off-season clothing, sports equipment and mementos can all be packed up and taken away. You’ll have to pack those items up to move anyway—why not do it in advance? Your home will look much larger when the rooms aren’t overcrowded with excessive furniture. Consider storing extra pieces in your storage unit.

Once every room has been decluttered and organized, it’s time to clean. Here’s a basic list of tasks for every single room in your house:

Every Room:

-

Wash windows.

-

Clean window blinds or replace if they’re broken.

-

Take down curtains, wash them, iron and rehang.

-

Remove light fixture coverings and wash them.

-

Replace burnt-out lightbulbs.

Bathrooms:

-

Scrub away all the hard water stains on the shower walls and fixtures.

-

Wash rugs or replace them.

-

Clean the vanity and sink thoroughly, including drawer and cabinet fronts.

-

Clear the vanity top of ALL personal items: hairspray, curling irons, makeup, etc.

-

Clean out and organize the inside of the vanity.

-

Treat any mildew or mold. Repaint if necessary.

-

Replace the toilet seat.

-

Take down and wash the shower curtain, or replace it.

-

Replace dated or broken fixtures.

-

Remove any clutter inside the bathroom.

-

Keep toilet, sink, mirror, tub/shower and floor clean at all times.

Bedrooms:

-

Replace stained, faded or worn bedding.

-

Remove extra furniture, exercise equipment or toys and put them in storage.

-

Keep beds made, floors vacuumed and furniture dusted at all time.

Family Room:

-

Remove excessive furniture.

-

Remove any clutter, personal items and photos.

-

Keep carpet vacuumed and furniture dusted.

Kitchen:

-

Thoroughly clean every appliance, inside and out. Remove grease from the range hood.

-

Clean the fronts of cabinets.

-

Remove clutter from countertops and table.

-

Remove everything from the front of the fridge: magnets, papers, pizza coupons, etc.

-

Clean out and organize cabinets

-

Wash or replace throw rugs.

-

Replace kitchen faucet if it’s broken, leaky or dated.

-

Keep floor clean, counters wiped off and dishes out of the sink.

While you’re in the process of showing your home, keep it as clean and clutter-free as possible.

Marketing Your Home

Once your home is ready to show, you’ll need to do some marketing to find prospective buyers. First, you have a few decisions to make.

Allow Buyer’s Agents, or Not?

You’re already saving 3% commission by selling your home yourself. The other 3% typically goes to the buyer’s agent. You usually can’t expect the buyer to pay the agent himself, so if you allow buyers to have a Realtor represent them, you should be ready to pay. The alternative is to specify in your advertising, and to anyone who asks, that you won’t allow a transaction to include a Realtor. There are pros and cons to each decision:

Pros: Allowing the buyer to be represented by a Realtor takes some of the pressure off of you and puts the responsibility for a timely transaction on the Realtor’s shoulders. During the escrow period, the buyer’s Realtor will coordinate a home inspection, negotiate for her client regarding any desired repairs and stay in frequent contact with the buyer’s lender to make sure that the mortgage process is going smoothly. Without the buyer’s Realtor, you can either leave all of that to chance, or take care of it yourself.

Pros: Allowing the buyer to be represented by a Realtor takes some of the pressure off of you and puts the responsibility for a timely transaction on the Realtor’s shoulders. During the escrow period, the buyer’s Realtor will coordinate a home inspection, negotiate for her client regarding any desired repairs and stay in frequent contact with the buyer’s lender to make sure that the mortgage process is going smoothly. Without the buyer’s Realtor, you can either leave all of that to chance, or take care of it yourself.

Cons: When the buyer is represented by a Realtor, he has someone who is savvy about the process. This can be a drawback for you, since you’ll be dealing with someone who has had a lot of practice with negotiation. If you don’t have much experience, you could be at a disadvantage.

How Much, and What’s Included?

We’ve already discussed how to go about figuring out a listing price for your home. Now’s the time to firm up that number. You’ll also need to figure out what will be included in the sale and what won’t. Here are the items that are automatically assumed to be included. They’re considered, “Real Property.”

We’ve already discussed how to go about figuring out a listing price for your home. Now’s the time to firm up that number. You’ll also need to figure out what will be included in the sale and what won’t. Here are the items that are automatically assumed to be included. They’re considered, “Real Property.”

-

Cabinetry that is affixed to the walls.

-

Appliances including stove, dishwasher wall ovens, countertop range, compactor, built-in microwaves and built-in wine coolers.

-

Decks

-

Outdoor fountains that are permanently installed with concrete.

-

Window fixtures, including blinds, shades and curtain rods.

-

Some mirrors, including those over the bathroom vanities and large floor-to-ceiling mirrors that are installed.

-

Bookshelves that are built-in or installed on the wall permanently.

-

Carpeting and installed flooring.

Basically, with the exception of some kitchen appliances, anything that is affixed to the wall or floor in a permanent manner is automatically assumed to be included. What’s not automatically included:

-

Refrigerator

-

Appliances that sit on the counter: microwave, small wine cooler, toaster oven, etc.

-

Hot tub

-

Furniture

-

Wall decorations such as pictures and mirrors.

-

Throw rugs

Avoid Potential Problems

In your listing and all your advertising, clearly state what’s not included. If you’re taking the hot tub with you, state it on your flyer. If you have a room with a huge throw rug that takes up most of the floor, the buyer might not realize that it’s not installed carpet. Point that out if you don’t want an angry call the day the buyer gets the keys.

More Trouble Than It’s Worth

Sometimes, taking something with you is more trouble than it’s worth. I once had a client who had a beautiful wall-mounted fountain in his entryway. It was very large, and quite expensive. It was also the immediate focal point upon entering the house.

Sometimes, taking something with you is more trouble than it’s worth. I once had a client who had a beautiful wall-mounted fountain in his entryway. It was very large, and quite expensive. It was also the immediate focal point upon entering the house.

Every buyer commented on how gorgeous it was. The client had decided that he wanted to take it with him when he moved, so we excluded it in the listing. When he got an offer, the new buyers begged him to sell it to them, but he refused. When it was time to move, he had the movers take it off the wall (it took three of them because it was so heavy).

Once the fountain was removed, there was a huge mess. The installers had nailed up extra 2x4s to hold the fountain in place. The paint was gone and the wallboard was full of gouges and holes. The owner figured he could just leave that for the new buyers.

I got a nasty phone call the next day when the buyers opened the front door of their new home to find a gigantic hole. Threatened with a lawsuit, the owner had to have someone come in and replace the drywall, then repaint the entire entryway. The moral of the story: If you take it down… you’d better take care of the damage.

Being Sneaky

Sometimes homeowners go under contract on their house, then start looking around and realizing that some of their fixtures are really nice—too nice to leave. They figure that the buyer won’t really remember that expensive chandelier in the dining room… they’ll just find a much cheaper one and replace it. Those custom switch plates, or expensive cabinet pulls? Those could also be replaced with more basic versions. After all, those things will all look great in the new house! And the buyer won’t even know. With the great deal he’s getting on the house, he can jolly well upgrade the cabinet knobs himself. So, after a brief, losing battle with his ethics, the homeowner pops over to Home Depot, buys some cheaper stuff and replaces a bunch of items in the home.

This happens more than you’d think. And it will get you in a lot of trouble if you try it. Your odds of getting caught are really high. Who would notice cabinet knobs? The buyer. Some seemingly insignificant items in a home often catch the eye of the buyer, who makes a mental note of those “cool stainless steel switch plates” or “classy copper cabinet pulls.” When those items aren’t in the house, the buyer will pull up your listing photos, or the photos he took with his cell phone during his visits to the home. And he’ll see (and be able to prove) the obvious: you are cheating him. Don’t try to be sneaky.

Advertising Your Home

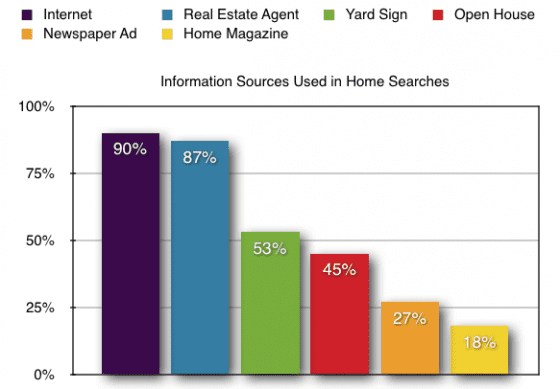

There are many ways to effectively advertise your property. The National Association of Realtors took a survey of home buyers in 2012 and asked them how they had searched for homes.

How do Realtors market homes? My colleague Greg Shuey wrote this great article for Realtors to help them come up with new ways to find clients. While you won’t be looking for long-term strategies, you’ll find some of Greg’s ideas very helpful when marketing your own home.

Signage

The most obvious of home marketing tools. Signage will get you noticed. If you do it right, it will give you lots of good exposure. If you do it wrong, it will hurt you more than it will help. At Signs.com, we’re experts on real estate signage. Here are some of our best tips for creating effective signs to sell your own home:

Less is More

You don’t need to put everything about your home on your signage. In fact, you shouldn’t. When designing your signs, think about one purpose for each. While every sign may say “For Sale By Owner,” some may have your address; others, your phone number. You can even design a banner that lists some features of your home, as long as it’s in front of your home, where people can park at the curb to read it. I talk about trying to put too much information on signage in this article. Check it out for more design tips.

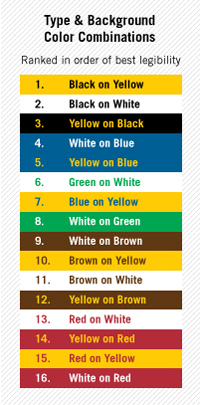

Colors

When it comes to signage, some colors work better than others. Try to avoid any color combinations that are difficult to read. Here are the best combinations, ranked in order of legibility. You’ll notice that hot pink and purple are not listed here… design accordingly.

When it comes to signage, some colors work better than others. Try to avoid any color combinations that are difficult to read. Here are the best combinations, ranked in order of legibility. You’ll notice that hot pink and purple are not listed here… design accordingly.

Fonts

Two important things to know about fonts:

1) They should be legible.

2) They should be large enough to be seen from far away.

I wrote an article about the proper (and improper!) use of fonts last year. You can read more about choosing the right font here.

Sign Types and Number of Signs

The most effective signs coordinate. They should all have the same color scheme and the same fonts. Ideally, you’ll have corrugated yard signs at all major intersections within a half mile of your home. Those signs should say “Home for Sale” and have your address.

The most effective signs coordinate. They should all have the same color scheme and the same fonts. Ideally, you’ll have corrugated yard signs at all major intersections within a half mile of your home. Those signs should say “Home for Sale” and have your address.

At every entrance to your neighborhood, two more corrugated yard signs (one for each direction of traffic), also with the home address.

At every entrance to your neighborhood, two more corrugated yard signs (one for each direction of traffic), also with the home address.

If it’s a distance of several blocks between the neighborhood entrances and your street, place a few more yard signs every 2 blocks or so. These should just say: “Home for Sale” and have an arrow pointing the way.

If it’s a distance of several blocks between the neighborhood entrances and your street, place a few more yard signs every 2 blocks or so. These should just say: “Home for Sale” and have an arrow pointing the way.

At both ends of your street, another directional sign with an arrow.

On your front yard, a larger sign. You could design a 6-foot vinyl banner with your phone number and a small bullet-point list of home features. Obviously you don’t need the address. And unless your price is an absolute steal, don’t list that either.

On your front yard, a larger sign. You could design a 6-foot vinyl banner with your phone number and a small bullet-point list of home features. Obviously you don’t need the address. And unless your price is an absolute steal, don’t list that either.

Online marketing

Buyers are looking online for homes. So, it makes sense that you’ll want to market heavily online. There are many companies online that will allow you to list on the public MLS for a fee. Your home will also be listed on the company’s website. While it might be tempting to skimp on costs and features, don’t do it. You get what you pay for when you’re purchasing an online service. You want to go with a company that has a large amount of traffic, and is listed on the first page when you do a Google search for “Homes for Sale by Owner.”

Two companies that offer listing capabilities and also have many other resources for folks selling their own homes are Zillow.com and ForSaleByOwner.com. Check them out and see what you think… we don’t have a stake in either company—but they both seem to be reasonably easy and inexpensive to use.

Social media marketing

While most people probably won’t head to Facebook to find a home, they may stumble across yours while scrolling through the cute kitten video posts and their friends’ statuses about what’s for dinner. Tell the world that your home is for sale on:

While most people probably won’t head to Facebook to find a home, they may stumble across yours while scrolling through the cute kitten video posts and their friends’ statuses about what’s for dinner. Tell the world that your home is for sale on:

- Google+

- MySpace

There are many more social media sites, but these are the top six, ranked according to unique monthly visitors.

Word of Mouth

Do you know who really loves your neighborhood and thinks it’s a great place to live? Your neighbors. And you know who comes over to visit them in their nice neighborhood? Their friends. When a Realtor lists a home, the first thing she does is send a postcard to all your neighbors. Why? They don’t want to buy your home; they already have one. The postcard serves two purposes: First, it allows your neighbors to find out how much your home is listed for without cleaning out the flyer box. Second, it alerts them to the fact that your home is for sale, so that they can tell their friends.

Realtors

Court buyers’ agents. These are the people who are talking to potential home buyers every day. Hopefully, you’ve decided that you’re willing to pay a buyer’s agent commission. If so, drop by a few brokerages, or send some emails or letters to Realtors in your area. You could host an open house for area Realtors, so that they can see first-hand how nice your home is.

Court buyers’ agents. These are the people who are talking to potential home buyers every day. Hopefully, you’ve decided that you’re willing to pay a buyer’s agent commission. If so, drop by a few brokerages, or send some emails or letters to Realtors in your area. You could host an open house for area Realtors, so that they can see first-hand how nice your home is.

Rhonda Taylor told me, “I’m certainly open to the idea of working with a FSBO property. I occasionally have a buyer who wants to look at homes offered by owners. Give me a call if you’re selling your own home and let me know about it. The odds of my buyers seeing your home are usually much lower, because I do all the work of finding properties for them to see, and I look on the MLS to find those. I’ve only shown a handful of FSBO properties in over 7 years in the business.”

Loan Officers

Realtors often partner with loan officers. The relationship is mutually beneficial: loan officers meet lots of people who are in the market to buy a home, and Realtors meet lots of people who want to buy a home and will need a mortgage. Referrals abound. You can take advantage of the same kind of relationship, and help your prospective buys at the same time.

Having some information about current interest rates and loan terms can be very helpful to prospective buyers. You could even design a sign for your front yard that has some sample terms and payments listed, based on your asking price. Just make sure to disclose that your numbers are just estimates.

Here’s a mortgage calculator that makes it easy to figure out sample payment amounts:

The Paperwork

Find an Escrow Officer/Title Company

You’ll need the services of a title company to complete a real estate transaction. Give the company a call early on and tell the escrow officer that you’re selling your home. She’ll need some information from you, including your social security number, date of birth, any previous aliases and the address of the property. The title company completes a title search to ensure that there are no liens on the home that will affect the transfer of the title to the new buyer.

You’ll need the services of a title company to complete a real estate transaction. Give the company a call early on and tell the escrow officer that you’re selling your home. She’ll need some information from you, including your social security number, date of birth, any previous aliases and the address of the property. The title company completes a title search to ensure that there are no liens on the home that will affect the transfer of the title to the new buyer.

You’re also required to purchase a title insurance policy as part of a real estate transaction. This policy will protect both you and the buyer from any unknown liens on the property.

The title company will hold the buyer’s earnest money until the transaction closes. The company will also need a copy of the completed purchase contract, once you’ve negotiated an agreement.

Get an Attorney

It goes without saying that the sale of your home is a high-stakes venture. We’re talking about a large sum of money. In addition, buying or selling a home is such a deeply personal transaction that emotions tend to run high. So many things can go so very wrong during a real estate transaction. And when things go wrong, people end up in court. At Signs.com, we sell signage. We’re not attorneys. So we found an attorney who would give us a little bit of input regarding the legal maze you’ll be wandering through during your real estate transaction.

Hal Armstrong is a partner at JLJ Law Group, where he handles real estate transactions for clients here in Utah. Hal was gracious enough to grant me an interview, during which I asked him some questions about when, why and how to hire an attorney, as well as some common legal issues that might come up for people during the process of selling a home.

When should a homeowner who wants to sell his own home contact an attorney?

Ideally, as soon as possible. Experienced real estate attorneys can provide valuable advice about local laws governing the advertisement and sale of real estate. We are familiar with common pitfalls that occur during transactions, and can give homeowners a heads-up to avoid such issues. We can also draft real estate contracts, or review existing contracts.

How do people find a competent, qualified attorney to handle the sale of their home? You guys usually have some sort of free consultation, right? What kinds of questions should someone ask an attorney to ensure that he’s the right guy (or woman!) for the job?

The Utah Bar Association has an attorney referral service where you can get a list of practitioners in the legal field you need, such as real estate. If you’re not in Utah, check with your state’s Bar Association. Free consultations are common—ask when you call for an appointment. When deciding if a particular attorney is a good choice for you, ask yourself these questions: Do you feel like you are being sold something? Do you think the attorney will be hard to communicate with? A sense of honesty is important, as well as organization and knowledgeability. Do they talk down to you or take the time necessary to explain what the issues are in whatever detail you need?

Do you guys have your own contracts with your clients that spell out your duties and obligations… along with those of the client?

Yes, that’s another thing, a huge thing for a client to consider when assessing potential counsel. What is the retainer agreement like? I have seen attorneys try to hold their clients to draconian retainer agreements that are so blatantly unfair that I do not think a court would enforce them. Some retainer agreements are pages and pages long, even for simple matters. If you don’t like the attorney’s retainer agreement, ask to modify it in writing so that the terms are agreeable. If the attorney refuses, trust your gut and get a different attorney. I keep my retainer agreement surprisingly simple, and I think most of my clients appreciate that. I also often tell them that this is not a take-it-or-leave-it contract, and if they are concerned about terms, please talk to me about them and maybe we can agree to other terms.

In addition to drafting a contract, or reviewing one, what other things could an attorney be hired to do in regards to the sale?

Receive notice, review zoning regulations, act as an escrow agent (for both parties) holding items in trust pending recording. Check title, although title companies are probably better and cheaper at this. Negotiate release of liens and other encumbrances on the property. That can be a big one, especially where many liens, in particular tax liens, can survive a bankruptcy and encumber the property even after the homeowner does not owe the debt anymore.

Can you explain what a “condition precedent” is, in relation to a real estate purchase contract?

A condition precedent is something that both sides agree (either explicitly or implicitly) must occur prior to the other side having an obligation under the contract. One of the most common in a real estate contract is financing. If a buyer can’t even obtain financing, what’s the point of trying to enforce the agreement?

What kinds of condition precedents should be included in most residential real estate purchase contracts?

Anything that you think would make you want to void the deal if it isn’t done. Passing inspections, appraising for the right amount to support the purchase price, and allow the buyer to obtain financing; being suitable for a particular purpose. Say the person is looking for a place where he can rent out half of it, but it is zoned solely for single-family dwellings. You want to make that clear, because what if neither of the parties have a clue about the zoning laws, and it is important. The normal REPC (by which I mean the one approved and copyrighted by the Board of Realtors) has provisions by which the parties can deny such warranties. An arbitration clause may also require the parties to arbitrate as a condition precedent to anyone bringing a lawsuit.

What are some common pitfalls you’ve seen during real estate transactions?

Many of the issues that arise during real estate transactions involve condition precedents and disclosures. For instance, an appraisal comes in much lower than the purchase price and there is a dispute regarding whether or not the buyer has the right to cancel, based on a condition precedent in the contract. Some issues are required by law to be disclosed to prospective buyers: the existence of lead-based paint, for instance. Other issues are not required to be disclosed. For instance, Utah law states that sellers are not required to disclose that a house is “stigmatized.” The definition of “stigmatized” includes the occurrence of a homicide or suicide at the property, which might reasonably upset a prospective buyer. Knowing up front what you’re legally obligated to disclose and what you’re not obligated to disclose can make a big difference if you have problems later, which is why it’s a good idea to consult an attorney early in the sales process.

The Offer and the Negotiating Process

Once you’ve found a buyer who is interested in purchasing your home, it’s time to negotiate a contract. A real estate purchase contract can have many components, and each is unique, depending on the agreement between buyer and seller.

Once you’ve found a buyer who is interested in purchasing your home, it’s time to negotiate a contract. A real estate purchase contract can have many components, and each is unique, depending on the agreement between buyer and seller.

Some homeowners purchase basic forms that cover their state’s requirements for real estate transactions. Others utilize the services of an attorney. Here’s a general explanation of some common elements you’ll find in a real estate purchase contract (REPC).

Common Elements of the REPC

Offer Date: The first element of a contract is typically the date of the offer, and the names of the parties involved.

Earnest Money: An important element to a binding contract is “consideration,” which is defined as “something of value.” Earnest money is one such form of consideration. In most cases, the buyer presents the seller with a check that will be deposited and held in escrow once the home is under contract. Earnest money is applied toward the purchase price of the home at settlement.

Property Description: The address of the home is shown on the contract, as well as a legal description of the property. You can find a legal description of your home on your Deed of Trust, or by calling or visiting your County Recorder’s Office.

Inclusions and Exclusions: The purchase contract should clearly state which items are included in the sale, and which are not.

Purchase Price: The purchase price for the home is clearly written into real estate purchase contract. The section may also include a breakdown of financing: how much cash the buyer will bring to the transaction, and how much money will be financed with a mortgage.

Settlement and Closing: There is a difference between settlement and closing. Settlement occurs when both parties have signed all the paperwork involved in transferring ownership of the property, and the buyer has presented required funds (not including the funds that will be generated with a new mortgage). Closing typically happens within 4 business days of settlement. Closing occurs once the bank has transferred certified funds to the seller or escrow office, and the closing papers have been recorded at the County Recorder’s Office. Deadlines for both settlement and closing should be recorded in the purchase contract.

It’s important to note that you haven’t officially sold your home until closing occurs. Though it’s rare, occasionally last-minute problems arise with bank funding, or with the title.

Possession: The date that the buyer may take possession is written into the contract. In most cases, the buyer should be able to receive keys to the home within a specified number of hours after closing has occurred.

Title Insurance: The seller of a home typically purchases a title insurance policy to protect the buyer from undiscovered liens on the property.

Seller Disclosures

Real estate purchase contracts contain a number of required seller disclosures. The disclosures required by your state may vary, but often include:

Property condition: This is disclosure document that requires the seller to list any known problems with the home. It covers a wide array of items—everything from foundation or roof leaks to broken appliances.

Copy of Covenants, Conditions & Restrictions for properties that are part of an HOA: If you’re selling a home that is part of a Homeowner’s Association, there is a set of rules and restrictions in place that governs what you can and cannot do with your property. The buyer is entitled to a copy of these rules (also called CC&Rs).

Minutes, Budget and Financials of HOA: Since the financial status of an HOA can impact the buyer, the minutes of the last HOA meeting, most recent budget and most recent financial report are often required to be disclosed to the buyer.

Claims and Conditions, Environmental Problems or Zoning Issues: If you’re aware of any zoning issues, or environmental problems relating to your property, you’re required to disclose them to the buyer.

Lead-based Paint: If your home was built prior to 1976, it may contain lead-based paint, which has been shown to be harmful, especially to children. You’re required to disclose that your home may contain lead-based paint, and also any specific problems of which you aware.

This section of the purchase contract will outline a deadline for the seller to present the buyer with these disclosures.

Buyer Conditions

These are conditions under which the buyer may cancel the contract. They may include:

Appraisal: If the home appraises for less than the purchase price, the buyer may cancel the contract.

Financing: If the buyer is unable to obtain financing, he may cancel the contract.

Due Diligence: The buyer may perform “due diligence,” which basically covers a host of inspections, tests and review of the seller’s disclosures and HOA information in order to ensure that the home is in acceptable condition to the buyer. Examples might include a home inspection by a certified home inspector or contractor, tests for lead-based paint, water contamination issues, radon, or other contaminates. If, after review, he finds that the home is not acceptable, he may cancel the contract.

This section of the contract also contains specific dates by which the buyer has to conduct his due diligence and present the seller any objections in writing. There are many other clauses that are often found in real estate purchase contracts. They’re designed to protect both the buyer and seller during the escrow period and can outline such issues as:

-

Insurance coverage during the escrow period, and the responsibility of the seller to repair any damage that occurs to the property prior to closing.

-

Remedies for default by either party.

-

The requirement for arbitration prior to court proceedings, should there be a dispute.

-

The responsibility for attorney’s fees, should arbitration or court proceedings occur.

Everything should always be in writing—especially changes to the original contract. A handshake is not binding, and can get you into real trouble. Once you’re under contract with a buyer, changes must be added in writing, in the form of an addendum.

Protections with a Realtor or Attorney

When you list your home with a Realtor, you’re protected by a few important distinctions:

1) The REPC used by your local Board of Realtors has been drafted and reviewed by real estate attorneys and covers the requirements for such contracts as outlined by your state’s laws.

2) Your Realtor has been educated regarding the requirements for the contract and addendums.

3) Your Realtor’s broker is ultimately responsible for any errors that occur during the transaction. The broker carries an insurance policy which provides for settlement of such issues.

When you sell your home yourself, you have none of these protections. Laura Hyde, “It’s so important to make sure that you’re covered legally. I’ve known several people who have completed transactions on their own, and things have gone wrong. They’ve been sued in court and have lost a lot of time and money that they would have saved had they listed their home with a Realtor.”

I cannot emphasize enough the importance of involving an attorney for the purchase contract and escrow period of the sale of your home. If you don’t have the protections provided by a Realtor and broker, you should have the professional knowledge of a real estate attorney.

Signs.com does not intend for this portion of the How to Sell Your Own Home Guide to be comprehensive, or in any way constitute legal advice. We advise you to seek counsel from a qualified attorney, who can guide you through the home-selling process and ensure that you fully meet every legal requirement of your home state.

Once You’re Under Contract

Getting an offer negotiated, signed and official, is just the beginning of the home-selling process. Now you’ve got to make sure that everything goes smoothly so that the buyer can pay for the home, and you can get your money.

Deadlines in the REPC

While you may feel as though you and the buyer have bonded over the negotiating process and are the best of buds, never forget that the REPC is a legally binding contract. The dates that are outlined in the contract are not to be casually dismissed, unless you want things to get ugly.

Make sure that you present the buyer with all your Seller’s Disclosures prior to the deadline. Also keep an eye on the buyer’s deadlines—he should be immediately working on getting a mortgage, ordering an appraisal and hiring a property inspector. It’s not your duty to remind him of the dates, but unless you want the contract to fall through, you’ll pay close attention.

Property inspection

The property inspection is an important part of the real estate transaction. It ensures that your home is in good condition, and puts the buyer at ease.

The buyer will be responsible for ordering and paying for the inspection, which usually costs just a few hundred dollars. The buyer (and his Realtor, if he has one), will arrange a time for the inspector to come and will meet him at the property before he completes his work. It takes a few hours for an inspector to thoroughly check out a home—he’ll go up on the roof, down in the basement and all over the house, testing appliances, light switches and outlets, looking for foundation cracks or roof leaks.

You might be nervous to have your home under so much scrutiny, and afraid that the inspector will find something wrong. Let me put your mind at ease right now. The inspector WILL find things wrong. Every time. No matter how nice your home or how well you’ve maintained it, every home has a few things amiss.

Rhonda Taylor told me about how she handles property inspections with her clients, “I always attend the inspection with my client so we can both hear what the inspector says. I like to be there to ask questions. Not all inspectors are trained on customer service; maybe they don’t communicate as clearly as they could. Sometimes my client freaks out when the inspector casually mentions a problem and breezes right over the issue. It’s usually not a serious issue, but I stop him and ask him to explain. What can we do to fix it? How expensive will it be? Is this serious or minor?

Rhonda Taylor told me about how she handles property inspections with her clients, “I always attend the inspection with my client so we can both hear what the inspector says. I like to be there to ask questions. Not all inspectors are trained on customer service; maybe they don’t communicate as clearly as they could. Sometimes my client freaks out when the inspector casually mentions a problem and breezes right over the issue. It’s usually not a serious issue, but I stop him and ask him to explain. What can we do to fix it? How expensive will it be? Is this serious or minor?

Anything that’s a big concern, you want the seller to fix. My client gives me a list of the items he’s concerned about. If there’s something that stood out to me during the inspection, I recommend adding it to the list, as well. The seller doesn’t have to fix those things, but the buyer also doesn’t have to buy the house if he’s uncomfortable with the issues found in an inspection.”

Once you’ve spoken to the buyer and agreed on the items that you’ll fix, you’ll need to fill out an addendum to the contract and both you and the buyer should sign it. In addition to a very specific list of items to be fixed, there should be a date clearly stated that outlines the time frame for which you have to take care of the issues. If you don’t meet that date, the purchase can fall through.

Appraisal

After you and the buyer sign that initial REPC, he will take a copy of it to his loan officer, who will begin working on obtaining the mortgage. Part of that process involves hiring an appraiser to come to your home, gather information and make a report to the bank that reassures the guys with the money that your home is worth what the buyer is paying.

The appraiser will call and make an appointment to stop by. He will usually prefer that you be at home in case he has any questions, and he will need access to both the exterior and interior of your home. The appraiser will be there anywhere from 2-4 hours, depending on the size of your home and the complexity of the appraisal.

Don’t bother asking the appraiser what your home appraised for as he’s leaving—he won’t know yet. After he returns to his office, he’ll conduct a lot more research and find some comps before he has a firm number. The appraisal belongs to the buyer (who’s paying for it), so you’re not entitled to a copy.

Closing Costs

There are closing costs associated with selling a home. You should plan on those costs being around 1.25% of the purchase price. Most of that amount is for the title insurance policy. The rest covers the escrow officer’s closing fees, document prep fees and recording fees.

You may be asked to pay for the buyer’s closing costs as part of the contract negotiation. This is fairly common, especially with first-time homebuyers who are already stretching to come up with a down payment and moving expenses. Buyer’s closing costs are typically around 3% of the purchase price.

Communication is Key

Throughout the escrow period, it’s important to stay in communication with your title company and the buyer (or his Realtor). If the buyer’s loan officer contacts you, make sure to be available for any questions he may have (he can’t and won’t share the buyer’s personal finance information with you, but he can usually provide you with an update on where he is in the process of obtaining the mortgage).

If any problems arise during this time, you’ll want to know about them immediately. By staying in contact with all the parties involved in the transaction, you’ll stay abreast of potential issues and may be able to resolve them quickly.

The Walk-Through Inspection

After you’ve attended Settlement, there is usually a day or two before the deal closes. Once the wire transfer from the buyer’s mortgage company has been received, the escrow officer will alert the County Recorder’s Office so that they can transfer the title to the buyer. Once that has occurred, the property is officially sold! The escrow officer will call you immediately, once she’s received confirmation that the documents have been recorded.

After you’ve attended Settlement, there is usually a day or two before the deal closes. Once the wire transfer from the buyer’s mortgage company has been received, the escrow officer will alert the County Recorder’s Office so that they can transfer the title to the buyer. Once that has occurred, the property is officially sold! The escrow officer will call you immediately, once she’s received confirmation that the documents have been recorded.

The REPC should have a date regarding the buyer’s possession of the home. On or just prior to that date, you’ll need to arrange a walk-through inspection with the buyer. You’ll walk through the property together, noting any repairs that have been made as agreed in the inspection addendum. If anything has been damaged between signing the contract and the final walk-through, you’ll be liable for those damages and required to repair them.

After the buyer has completed his walk-through with satisfaction, you’re done. You’ll hand over the keys and be on your way to a new home.

Thanks to the Pros!

A special thanks to the following people who contributed greatly to this article:

Hal Armstrong is a partner at JLJ Law Group and practices real estate law, in addition to handling other civil and criminal cases. He can be reached at 801-386-7161.

Laura Hyde is a Realtor with Thornton Walker Real Estate, Inc. She can be reached

at 801-450-6517.

Rhonda Taylor is a Realtor with Blakemore Real Estate LLC. She can be reached

at 801-750-5295.